- Home

- Linda Yueh

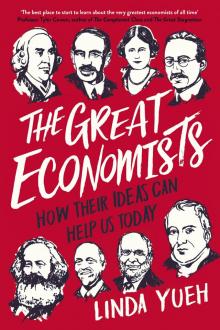

The Great Economists

The Great Economists Read online

Linda Yueh

* * *

THE GREAT ECONOMISTS

How Their Ideas Can Help Us Today

Contents

Introduction: Great Economists on Our Economic Challenges

1. Adam Smith: Should the Government Rebalance the Economy?

2. David Ricardo: Do Trade Deficits Matter?

3. Karl Marx: Can China Become Rich?

4. Alfred Marshall: Is Inequality Inevitable?

5. Irving Fisher: Are We at Risk of Repeating the 1930s?

6. John Maynard Keynes: To Invest or Not to Invest?

7. Joseph Schumpeter: What Drives Innovation?

8. Friedrich Hayek: What Can We Learn from Financial Crises?

9. Joan Robinson: Why are Wages so Low?

10. Milton Friedman: Are Central Banks Doing Too Much?

11. Douglass North: Why are so Few Countries Prosperous?

12. Robert Solow: Do We Face a Slow-Growth Future?

Epilogue: The Future of Globalization

Notes

Bibliography

Glossary

Acknowledgements

Follow Penguin

To my family

Introduction: Great Economists on Our Economic Challenges

During times of fundamental change, economic expertise is in demand. Who better to help shape our economic future than the Great Economists? Their thinking transformed the modern economy into one characterized by unprecedented prosperity, relatively speaking, in even the poorest countries. Those ideas from the past can help guide us as we confront today’s economic challenges.

Now is an ideal time to assess where the world economy is headed. Having come through the global financial crisis of 2008 and the Great Recession that followed it, the US, Britain, the European Union, Japan, China, and others are experiencing significant challenges to growing their economies and generating wealth. America, for long the leading economic engine of the world, faces the prospect of slowing growth as slow wage growth weighs on its future. In Britain, weak productivity growth and the historic referendum of June 2016 that resulted in a vote to leave the European Union will affect the country’s economy for years to come. The EU, meanwhile, faces difficult questions about how to reform the euro area’s economy to generate growth while sharing a single currency, the euro. Concerns over slow growth have long confronted Japan, which is at the forefront of a number of innovative economic policies to energize its sluggish economy, while China, too, faces structural challenges as it attempts to join the ranks of the world’s rich countries. Emerging economies such as those in Asia, Africa, Latin America, and eastern Europe are also in the spotlight. After years of strong growth, they are slowing down, which raises the question whether these nations will have enough economic momentum left to eradicate poverty within their borders. Yet, we also live during a time of rapid technological change, much like the previous Industrial Revolutions that raised our living standards. We’ll also consider what drives innovation and how to increase economic growth.

Who, then, were these Great Economists whose theories changed the world and whose ideas can help us with our challenges today? It was a difficult choice to make. Applying the criterion that their work must have direct implications for our current economic problems helped a little, but there remain many not on my list who might arguably have been included. Hyman Minsky, for example, who is discussed in the Irving Fisher chapter because the pair’s combined thinking helps us better to understand the nature of financial crises. And Paul Samuelson’s ideas on the distributional impact of international trade builds on the work of David Ricardo, so his thinking provides considerable insight into how those who have lost out in the globalization process discussed in the Epilogue might better manage their predicament.

This leads on to my second qualifier, which is that my selections also reflect the issues that I have chosen to focus on. Choices had to be made, so I have whittled a huge list down to one that is centred on economic growth – that is, the rate and the quality of development. How economies grow will be affected by the policy choices taken after the worst banking crash in a century and in the context of a globalized world. The 2008 financial crisis and the rise of emerging markets are among the fundamental factors in the past few decades that have transformed and will continue to reshape the world economy. The crisis showed that some of the old ways of growing an economy are unsustainable, while the fast growth of a number of developing countries suggests that it’s time to examine how they did that and what it means for big global challenges such as eradicating poverty. Some countries have already confronted some of these issues, and therefore hold potential lessons for other nations. For instance, what can we learn from how the US and UK have been re-examining their growth drivers after the 2008 crisis, or how China has emerged as a major economy so rapidly? Other examples include how Europe is planning to increase investment to boost economic growth, and Japan’s attempts to end decades of economic stagnation through massive government intervention. So, the quality and nature of economic growth will be central to this book.

You will note that I have largely chosen economists from an earlier vintage. The Greats, unsurprisingly, tend to focus on big general questions, such as growth, innovation and the nature of markets. Of course, there are eminent economists who are currently working on key problems. Many of the recent Nobel laureates are actively engaged in current policy debates, such as raising economic growth rates and assessing the role of government spending, but their research is rooted in the work of the originators of the general models that form the foundation of economics. This book reveals who those Great Economists were, where their ideas came from and how their insights have shaped economic thinking.

Unsurprisingly, my first subject is Adam Smith. It is almost a truism that all economists first turn to Smith when confronted with an economic question. I was reminded of it recently when I presented a BBC radio programme. I asked an academic why we tend to overlook the dominant services sector and instead focus on manufacturing, which comprises only around one-tenth of the British and American economies. He referred immediately to Adam Smith, who thought that the services sector was unproductive. Smith believed that the sector was comprised of ‘buffoons, musicians, opera-singers’,1 whose output could not be traded and therefore did not add to national output in the same way as manufacturing. Smith was, naturally, a product of his times, which witnessed the advent of industrialization that led to an unprecedented increase in incomes and living standards. His 1776 The Wealth of Nations is the seminal work on the subject. Smith’s legacy is evident in nearly every aspect of economics. We still view the economy through the lens he fashioned.

So, Adam Smith is the first Great Economist in the book. His idea of the ‘invisible hand’ of market forces – meaning the innate effects of supply and demand, rather than direct intervention by governments or other institutions – is the foundation of economic theory. As I explored in that Radio 4 programme, the British government is trying to rebalance the economy towards making things once again, after the 2008 crisis revealed the downsides of relying too much on financial services. So far they haven’t succeeded. A decade later, the services sector has recovered to pre-recession levels, while manufacturing has not. And it’s not just Britain. America, China and other major economies are also seeking to rebalance their economies so that they can grow in a more sustainable fashion. What would Adam Smith say about these attempts? How would he reconcile his affinity for manufacturing with an aversion to governments intervening in the workings of the ‘invisible hand’?

An economist inspired by Adam Smith later became the father of international trade. In 1817 David Ricardo formalized the theory of comparative advantage that shows

how every country benefits from free trade. This is true even if that country is worse than every other country in the world at producing everything. It should still focus on making what it was relatively less bad at, and specializing and trading would benefit it as well as the rest of the world. But, what if the result of trading on the basis of comparative advantage is that countries like America and Britain run persistent trade deficits, meaning that the value of the goods they import outstrips the value of their exports? What would Ricardo advise governments to do?

Karl Marx viewed the Industrial Revolution rather differently from Adam Smith. Although he too experienced the dramatic transformation of Western economies in the nineteenth century, Marx rejected market-driven outcomes and instead favoured collectivization over capitalism. He viewed the market economy as exploitative and unsustainable, and his views led the former Soviet Union and China, among others, to adopt a communist rather than capitalist system.

The collapse of the Soviet Union is generally viewed as an indictment of central planning. By adopting market-oriented reforms, China has emerged as the world’s second largest economy. Still, China is undergoing perhaps the most challenging part of its marketization process. How would Marx judge the trail that the Chinese economy is blazing?

On the opposite side of the planning – market spectrum from Karl Marx was his near contemporary Alfred Marshall. Instead of the government running the economy, Marshall formalized how Smith’s ‘invisible hand’ achieves an equilibrium for the economy through market forces. He showed how supply and demand determine the price and quantity of a good. Marshall’s belief in a self-correcting market that moves towards an equilibrium means that we only need a laissez-faire state. There is no imperative for the government to intervene a great deal in the workings of the market economy, for instance, in the ups and downs of a business cycle. But, how about redistributing income in the face of rising inequality? How would Marshall have viewed inequalities that have burgeoned as the benefits of a growing economy disproportionately accrue to the top 1 per cent?

There’s no doubt that inequality is high on the policy agenda, a reminder that we must consider the quality and not just the speed of economic growth. A best-selling book on the topic of inequality is by the French economist Thomas Piketty. Its popularity reflects a widespread concern that inequality is as high now in America as the Gilded Age of the late nineteenth century. A recent economics Nobel laureate, Joseph Stiglitz, has even pointed to inequality as one of the causes of the slow recovery after the Great Recession. So, how would Marshall view the worsening of income inequality which is often perceived as an indictment of capitalism? Are capitalist economies inevitably unequal?

Concerns over economic growth have certainly heated up since the 2008 global financial crisis, which was the worst economic downturn since the Great Depression of the 1930s. America was the epicentre, and Britain was deeply affected. Years later, there are still high levels of debt and less than robust economic growth. Irving Fisher, who lived through it, warned about the danger of the debt-deflation spiral after such crises. It’s what Japan has experienced since its early 1990s real estate crash. As debt was repaid, output fell which led to falling prices or deflation and ‘lost decades’ of growth. What would Fisher advise in order to ensure that countries do not face ‘lost decades’ of growth? Are we at risk of repeating aspects of the 1930s, which was characterized by a second recession and stagnant income growth?

Arguably the economist who has been most discussed since the recent downturn, when unemployment returned as a worrying problem, is John Maynard Keynes. According to the think tank for the group of developed nations known as the Organisation for Economic Co-operation and Development (OECD), the long-term unemployment rate (a measure of those who have been out of work for more than one year) had increased by a staggering 77 per cent in the aftermath of the 2008 crisis. Youth unemployment reached double digits in some European countries such as Spain. It’s less of an issue for the US and UK, but other forms of ‘hidden’ unemployment, such as underemployment and part-time work, are concerns. So, the role of government in promoting employment and reviving growth is front and centre in public policy.

It is well known that Keynes did not believe in the market’s ability to self-correct, which was the dominant economic thinking at the time. Instead, he argued for government spending, and incurring a budget deficit if necessary, to bring the economy back to full employment. His views were shaped by the persistently high unemployment rates that followed the Great Depression, and Keynes’s ideas made him an influential figure, even posthumously during the post-war period which saw the birth of large government programmes such as the welfare state.

In another parallel to today, the dominant economic debate since the Great Recession of 2009 has been over austerity – cutting government spending and raising taxes to reduce the budget deficit. One of the results of austerity measures is a huge drop in government/public/state investment, which hampers economic growth. Looking ahead, what would Keynes advise today’s governments to do about public investment, an important driver of growth and full employment in the economy?

Another big economic debate is over how to make economies more productive. Recovery since the financial crisis has been slow by historical standards. Raising productivity, which has stagnated in many developed economies, is crucial if the economy is to grow; but it requires innovation. This may be the most important policy question for advanced economies, and the Great Economist best placed to address it is Keynes’s contemporary and the advocate of ‘creative destruction’: Joseph Schumpeter. Schumpeter’s theory placed entrepreneurs and innovators at the heart of not just the recovery but overall economic growth. So, what would he advise governments do today in order to raise productivity and innovation?

Another influential contributor to economic policy around that time was Friedrich Hayek. Hayek was the standard bearer for free-market economics. He was part of the Austrian School of economics, which rejected, among other theories, the standard explanations of business cycles. Hayek was diametrically opposed to the views of Keynes and believed in the supremacy of market forces. Hayek opposed the use of monetary policy, which is when the cost and quantity of money in the economy is adjusted to influence growth, as well as Keynes’s fiscal activism, setting him at odds with much of the economics profession. Although Hayek found an intellectual home at the London School of Economics and Political Science, his theories are still not widely accepted in academia. With capitalism itself now under attack in the aftermath of the Great Recession by the Occupy movement and others, Hayek’s ideas have come back into fashion as the search continues for arguments to defend the market system against growing scepticism. Those ideas can help us discern whether there are any lessons to be learned from the financial crisis.

Joan Robinson, another of the twentieth-century’s leading lights, is the sole woman among the Greats in this book, which reflects the chronic dearth of women in economics. When I was an economics doctoral student at Oxford University, I found her theories on imperfectly competitive markets highly insightful. For instance, one of the most pressing economic challenges is low wages. The UK has the dubious distinction of being the only one of the G7 group of major economies where average annual wage growth failed to match inflation for much of the decade since the financial crisis. A general lack of growth in ‘real wages’ is a problem that goes beyond this last recession, and beyond UK shores. Japan and Germany have faced twenty years of stagnant wage growth for those workers earning the median wage, that is to say those whose earnings fall in the middle section of the pay distribution spectrum. Even worse, median wages in the United States have been stagnant for four decades. This is where Joan Robinson’s work offers insights. In the two key factor markets, namely capital and labour, Robinson showed how deviations from the assumption of perfect competition, where all markets operate efficiently, can explain low wages and why pay does not reflect the output of workers. We’ll ask what rem

edies Robinson might offer to address the challenge of stagnant wages plaguing major economies.

The next Great Economist certainly did not suffer from a lack of attention. Milton Friedman famously coined the phrase ‘Inflation is always and everywhere a monetary phenomenon.’ Friedman believed that the amount of money in the economy only affected prices, and therefore inflation, but not national output in the long run, which is the monetarist view of economics captured by his well-known quote. Throughout his long life Friedman remained an advocate of the free market and even initially considered the establishment of America’s central bank, the Federal Reserve, to have been a mistake. Although he later accepted that the Fed was necessary to control the money supply, he insisted it should be confined to that role, and not be an activist institution. Unsurprisingly, he disagreed with the Keynesian view that fiscal policies have a lasting impact on the economy.

Part of the Chicago School of economics, in 1963 Friedman co-wrote with Anna Jacobson Schwartz one of the most influential books on monetary policy: A Monetary History of the United States, 1867–1960. They revisited the causes of the Great Depression to understand what happened and why it took so long to recover from the 1929 stock market crash. Their conclusion is that monetary policy was the culprit, specifically the Fed prematurely tightening the money supply, which they argued caused the crash and also led to a second economic downturn, known as a ‘recession within the Depression’, of 1937–38. So, what would Friedman say about the use of ‘unconventional’ monetary policy in the aftermath of the Great Recession with its parallels to the 1930s? Central banks have now deployed a dazzling array of policies, including quantitative easing (cash injections) and even negative interest rates (where commercial bank deposits at the central bank are being charged) to get more money into the economy. What would Friedman make of the activities of central banks which are largely operating in unknown territory?

The Great Economists

The Great Economists